Right now, grab a piece of paper or open the notes app on your phone. In the next 10 minutes, you are going to build a real budget for your money, one that actually works.

A budget is simply a plan for your money. It helps you track your income and decide your expenses before you even spend a single penny. By the end of this page, you will have your very own financial plan ready to go.

Imagine you are the captain of a massive ship. You wouldn't just let the wind blow you anywhere, right? You would use a map to make sure you reached the Treasure Island.

A budget is that map. It stops your money from just 'disappearing' and helps you steer it toward the things you really care about, like that new game, a cool gift for a friend, or a big LEGO set. Let's build your map right now.

Beware of little expenses: a small leak will sink a great ship.

Step 1: Figure Out Your Income

First, we need to know how much money is coming into your 'ship.' In the world of money, this is called your income. Even if you do not have a regular job, you likely have money arriving from different places.

Write down every way you get money. This might include:

- Weekly or monthly pocket money

- Cash from birthdays or holidays

- Extra money for doing odd jobs like washing the car or weeding the garden

- Selling old toys or books

Finn says:

"What if I don't get pocket money every week? Can I still make a budget with just my birthday money?"

If you do not get the same amount every week, that is okay. Just write down an estimate of what you usually get in a month. This gives you a starting point for your plan.

Step 2: List Your Expenses

Now comes the part where you decide where the money goes. These are called your expenses. These are the things you choose to buy or the money you choose to set aside.

Think about what you usually spend money on in a normal week. Try to be as honest as possible. You might include:

- Snacks or drinks after school

- In-game purchases or apps

- Cinema tickets or bowling with friends

- New books or magazines

Imagine you have £20. You buy a small toy for £5, a drink for £2, and some sweets for £3. Suddenly, your friend invites you to the cinema, which costs £12. Because you didn't have a plan, you are £2 short and can't go. A budget helps you see these 'traps' before you fall into them!

Step 3: Assign Every Penny a Job

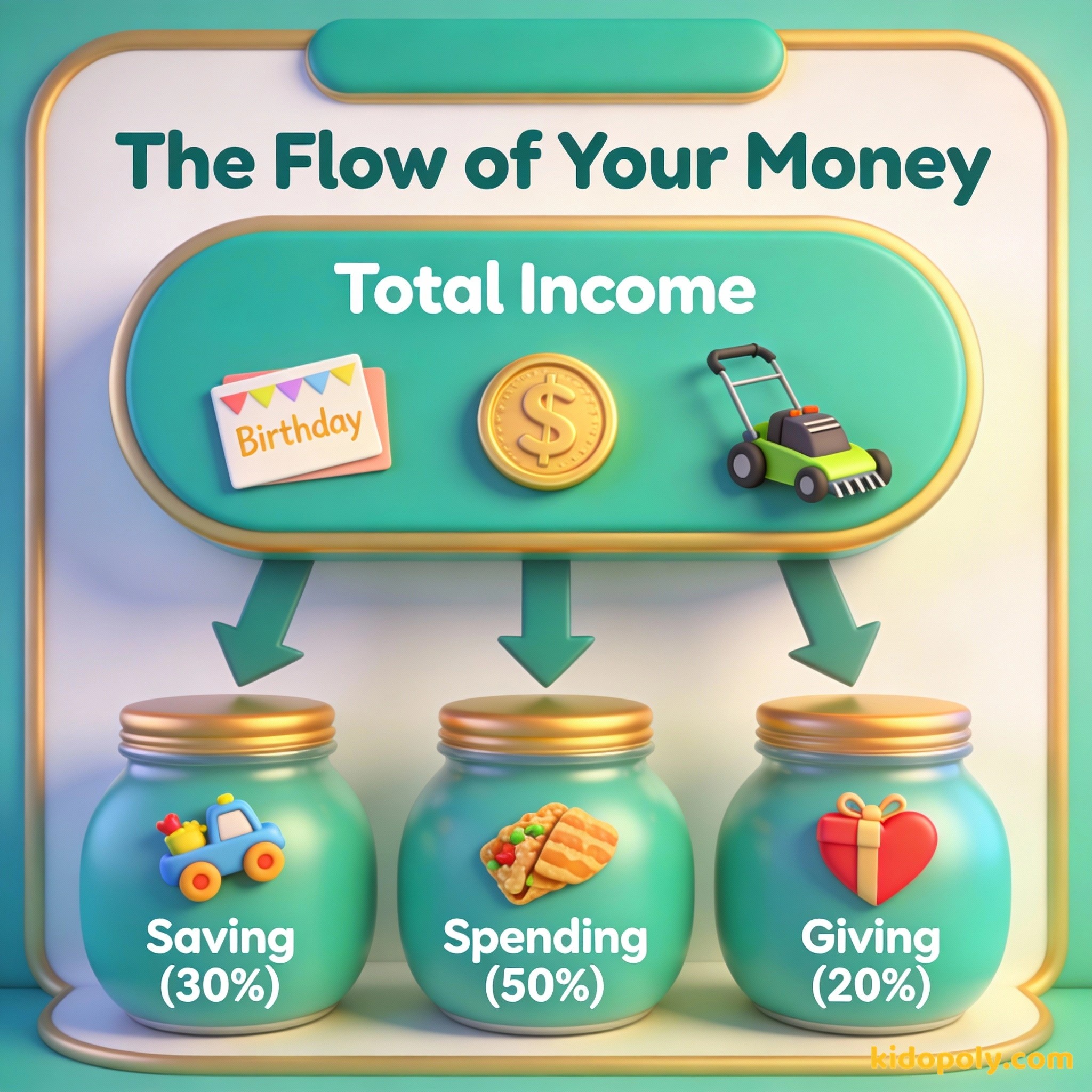

This is the most important step. You are the boss, and you need to tell every pound or dollar exactly where to go. A great way to do this is to use the 'Three Jar' method.

You do not need to be a math genius to do this. You just need to decide what percentage of your income goes into each category. You might try the 50:30:20 rule, which is a popular way adults and kids manage their money.

The 50/30/20 rule is a simple way to split your money. 50% goes to 'Needs' (like school lunch or bus fare), 30% goes to 'Wants' (fun stuff), and 20% goes to 'Savings' (your future). Since your parents usually cover your 'Needs,' many kids change this to 50% Spending, 30% Saving, and 20% Giving!

Do not save what is left after spending, but spend what is left after saving.

Step 4: Choose Your Method

How are you going to keep track of your plan? You need a system that feels easy and fun, otherwise, you might stop doing it. There are three main ways most kids manage their first budget:

- The Envelope Method: Use three physical envelopes or jars labeled Spend, Save, and Give. When you get cash, physically split it up. This is great if you use real coins and notes.

- The Notebook Method: Use a dedicated notebook to write down your income and every time you spend. It is like a diary for your wallet.

- The Digital Method: Use a simple spreadsheet or a budgeting app made for families. This is perfect if you mostly use a digital card or your parents keep your money in a bank account.

It is fast, easy to carry, and you can decorate it with stickers and drawings. It helps you remember things better when you write them by hand.

It does the math for you! It is harder to lose than a piece of paper, and you can see cool graphs of your spending over time.

Mira says:

"I like the Envelope Method because I can actually see the 'Save' pile getting bigger. It feels like leveling up in a game!"

A Real-World Example

Let's see how this looks for a kid named Sam. Sam gets £10 every Saturday for doing chores. Instead of just putting it in a pocket and hoping for the best, Sam uses a 50:30:20 budget.

Sam's £10 Weekly Budget: - SPEND (50%): £5.00 (For comics or snacks) - SAVE (30%): £3.00 (For a new bike) - GIVE (20%): £2.00 (For charity or friend's birthdays) Total: £10.00. Every pound has a job!

By following this simple plan, Sam knows they can spend £5 today without feeling guilty. They also know they are 'paying' their future self £3 every single week. After a few months, that saving jar will be full enough for a big treat!

Step 5: Track for One Week, Then Adjust

A budget is not set in stone. It is a living thing! Your job is to try your budget for seven days. Write down every single thing you buy.

At the end of the week, look at your list. Did you spend more on snacks than you planned? Did you forget to include a birthday gift for a friend? That is totally normal. Budgeting is a skill that takes practice.

Mira says:

"So, if I find out I'm spending too much on stickers, I just change the numbers for next week? It's like a science experiment with my own money!"

A budget is telling your money where to go instead of wondering where it went.

What If You Go Over Budget?

Don't panic! Even professional financial experts go over their budgets sometimes. If you spent your 'Spend' money too fast, you have two choices. You can either stop spending until next week, or you can move money from another category.

However, try not to touch your 'Save' jar unless it is a real emergency. The goal is to learn how your spending habits work. If you find you are always running out of money for snacks, maybe you need to adjust your categories next week.

The 'Wait-a-Week' Challenge: Next time you want to spend your 'Spend' money on a toy or game, wait exactly 7 days. If you still want it then, and it fits in your budget, buy it! Most of the time, you'll find you didn't really want it that much after all.

Something to Think About

If you could only pick one thing to save up for this year, what would it be?

There is no right or wrong answer here. Your budget is a tool to help you get what you value most, whether that is a new toy, a gift for someone else, or just the feeling of having money in the bank.

Questions About Spending & Budgeting

How often should I check my budget?

What if I want to buy something that costs more than my 'Spend' jar?

Should I budget the money I get for my birthday?

You're the Boss of Your Bank Account!

You now have a working budget! Remember, the goal isn't to be perfect, it is to be in control. By knowing where your money goes, you are building a superpower that will last your whole life. Ready to start tracking? Check out our guide on how to set your first saving-goals or learn more about the difference between needs-vs-wants.